Venturing in to cfd trading can seem overwhelming, but breaking it down step-by-step makes the procedure significantly clearer. That guide supplies a concise overview for new traders anxious to know Contracts for Big difference (CFDs). With the proper method, newcomers may learn the rules and begin trading confidently.

Understanding CFD Basics

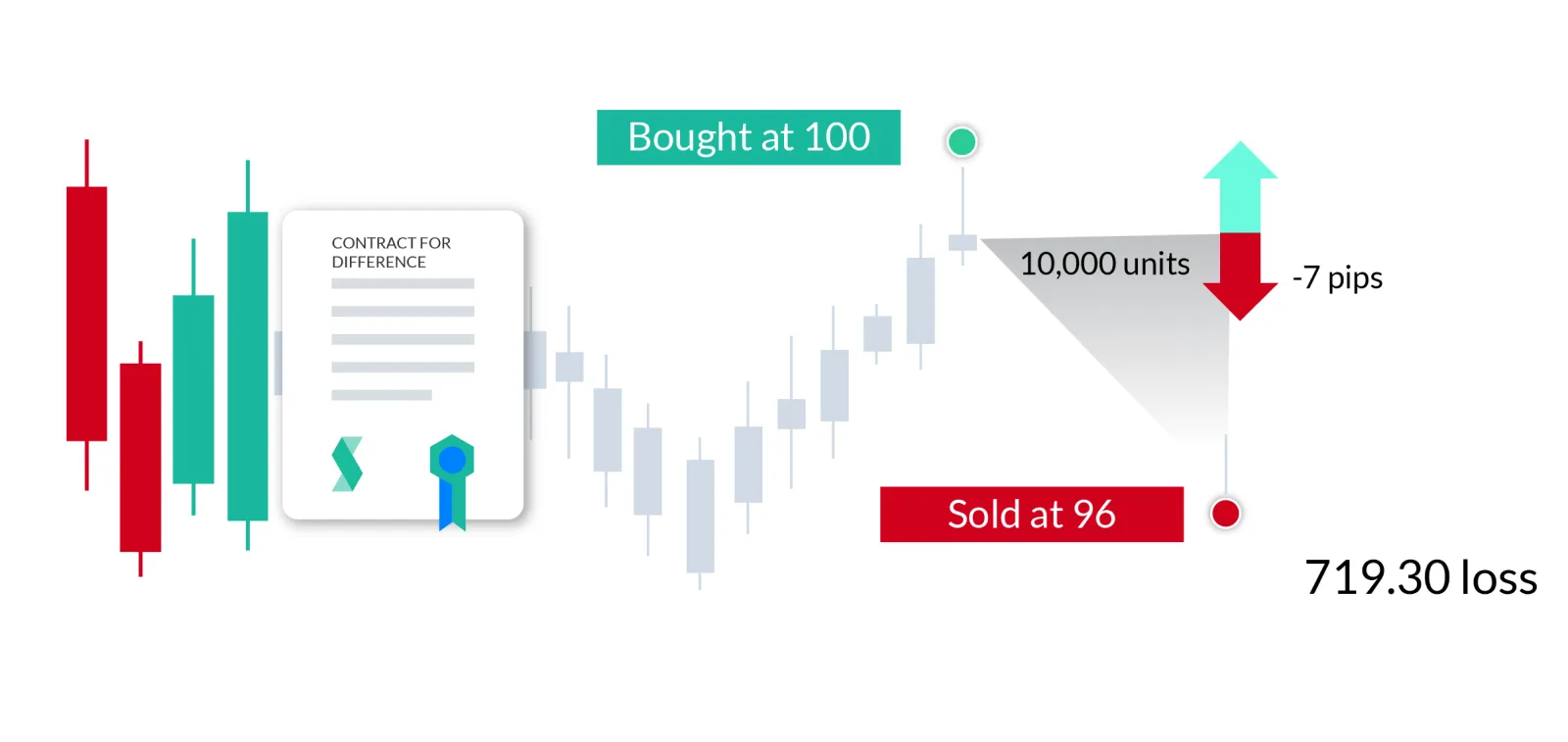

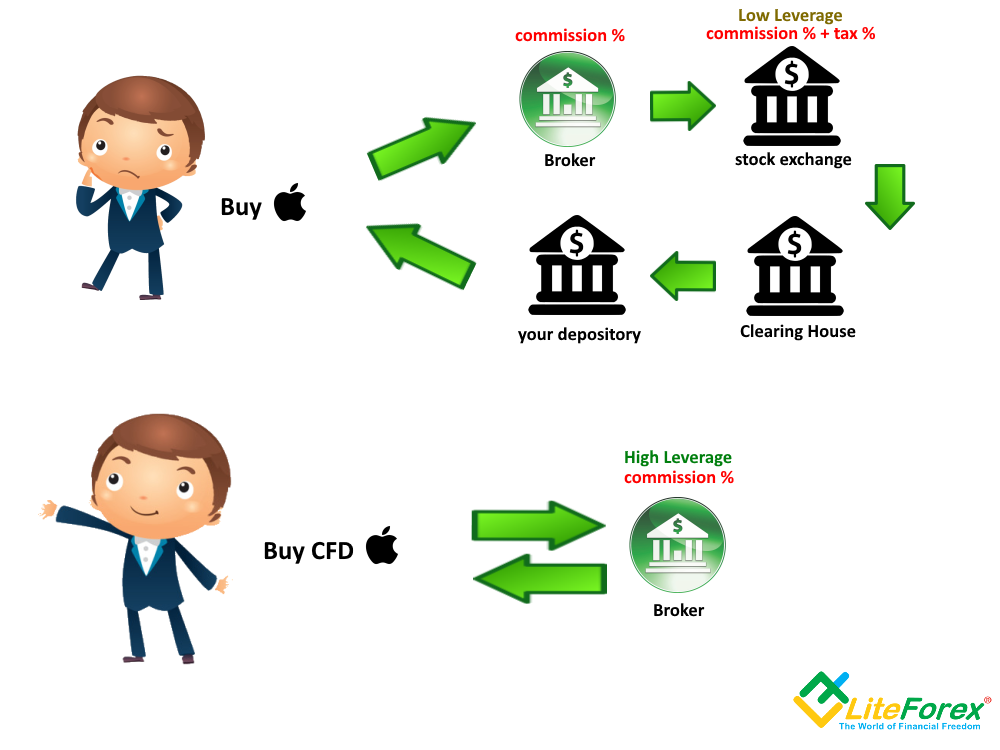

Agreements for Huge difference are financial derivatives that enable traders to speculate on price activities without owning the main asset. When trading CFDs, you're basically predicting whether the value of a tool may increase or fall. If your prediction is right, you make a gain; or even, you incur a loss. This type of trading is popular due to its freedom and the capability to industry on margin.

Beginning Your CFD Trading Trip

Before you begin, it's crucial to comprehend the market thoroughly. Start with studying various resources you are able to trade through CFDs, such as for instance stocks, indices, commodities, or currencies. After you've chosen a tool, familiarize your self with its industry conditions and how outside factors might affect their price. Understanding these things may help you produce informed decisions and reduce risks.

Next, get confident with the trading platform you'll be using. Several platforms present demo accounts where you are able to training without risking actual money. Utilize this function to examine various methods and understand the trading process. Look closely at how leverage performs, as it can certainly amplify equally profits and losses.

Developing a Trading Technique

A great trading strategy is vital for success in CFD trading. Start with defining your goals and chance tolerance. Choose the quantity you're prepared to invest and the level of chance you're comfortable with. It's also essential to ascertain your access and quit details for each business, as that will allow you to avoid creating impulsive decisions.

Yet another critical part is managing your risk. Implement stop-loss and take-profit instructions to protected increases and restrict losses. This process assures that you keep get a grip on around your trades and protect your investments, even if the marketplace varies unexpectedly.

Entering the CFD Industry

After you're familiar with the fundamentals and allow us a method, it's time and energy to enter the market. Start by creating small trades to gain self-confidence and experience. Monitor your trades tightly and hold understanding from each one. Over time, you'll develop a greater knowledge of industry designs and enhance your decision-making skills.

In conclusion, CFD trading offers interesting opportunities for new traders willing to set up the effort to master and practice. By understanding the basic principles, having a strong strategy, and controlling risks effectively, beginners will find accomplishment in this dynamic market. Remain individual, keep understanding, and your trading skills can develop over time.